The Big Short on Snow

Written by Kevin Wittig

The Big Short On Snow

It’s safe to say the winter of 2012 has been the worst year on record for ski areas. Above average temperatures, combined with abysmal snow accumulations, negatively impacted mountain communities worldwide. As marketing gurus attempted mercilessly to convince and convert winter enthusiasts, Wall Street executives relished in the profits piling up from bets against snow. “How?” you might ask. By trading a new type of weather investment called snowfall futures.

Preceding the winter season, the Chicago Mercantile Exchange announced an expansion to its CME Snowfall Index. Referred to as snowfall futures, the contracts are similar to an insurance policy, paying out a set amount of money for every inch over or under a predetermined value. Originally intended as a method for businesses to hedge against unpredictable weather events, the market evolved, and become attractive to investors willing to accept risk in pursuit of high returns.

The La Nina Effect

The La Nina weather cycle normally produces above average snowfall in the western Rockies. Upon its detection by NOAA in the fall of 2011, resort marketers seized the opportunity. Ski areas went into overdrive generating hype around the weather phenomenon to increase bookings. Simultaneously, businesses burned by heavy snowfall months earlier took measures to avoid a repeat scenario.

During the month of November, companies that previously hadn’t invested in the CME Snowfall Index stepped in to purchase options. The market volume for snowfall futures exploded. As interest in the long end (buy-side) of the trade surged, fund managers sensed an over reaction, and subsequently stepped in to take the short side of the future contract, effectively betting against snow.

Photographer: Kerry Lofy, Unofficial Steamboat

In retrospect, it’s easy to understand how various industries are vulnerable to the effects of snow. Property management firms, snow removal companies, salt suppliers and even department stores, correlate profits to winter precipitation. This means they assume risk, or exposure to weather. While snowfall futures offer businesses an instrument to manage their risk, from an investor perspective, the opportunity presents itself to capitalize upon fear.

During the turmoil of holiday marketing, the ski industry didn’t take notice of increased activity in the CME Snowfall Index. Wall Street, on the other hand, sensed an overreaction, and bet that the effects of La Nina were a bust. They were right. While skiers and riders performed ceremonial snow dances to conjure white gold from hibernation, investors profiting from the lack of snow laughed their way to the bank. Now, in the wake of the worst winter season on record, the only question that remains is when ski resorts will join the party and bet against snow.

Photographer: Scott Franz, Steamboat Today

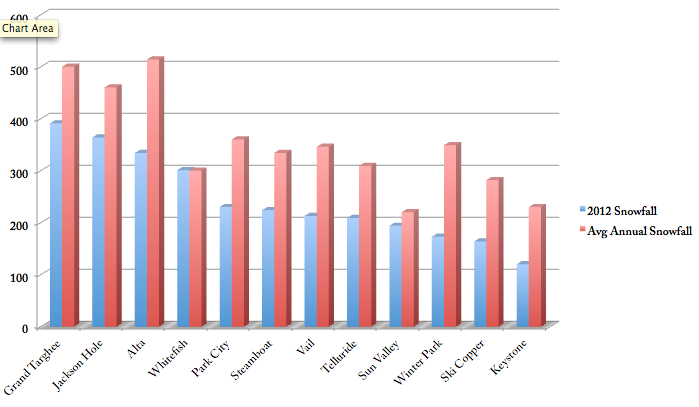

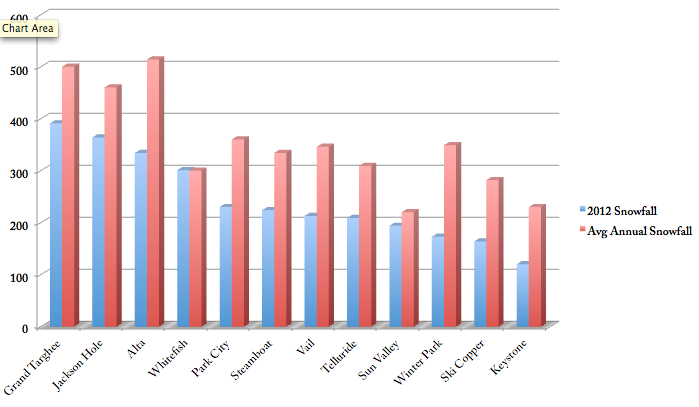

2012 Winter Snowfall Totals vs. Annual Averages

Inspired from an article written in Time Magazine by Stephen Gandel. Twitter: @stephengandel

Other Posts from The Mountain Pulse

Tweet

!function(d,s,id){var js,fjs=d.getElementsByTagName(s);if(!d.getElementById(id)){js=d.createElement(s);js.id=id;js.src="//platform.twitter.com/widgets.js";fjs.parentNode.insertBefore(js,fjs);}}(document,"script","twitter-wjs");

02/18/14 - A break in the storm reveals the sight that never gets old, a breathtaking sunset in Grand Teton Nation Park. Photographer: Stephen Williams

Previous Photos

Read More

Tweet

!function(d,s,id){var js,fjs=d.getElementsByTagName(s);if(!d.getElementById(id)){js=d.createElement(s);js.id=id;js.src="//platform.twitter.com/widgets.js";fjs.parentNode.insertBefore(js,fjs);}}(document,"script","twitter-wjs");

The 43rd Annual Shriner's Cutter Races

Previewed By: Adam Glos

Saturday, February 15th // Sunday, February 16th

Melody Ranch // Jackson, WY

12:00 pm – 3:00 pm

General Admission: $15

This weekend, give your ski ...

Read More

Tweet

!function(d,s,id){var js,fjs=d.getElementsByTagName(s);if(!d.getElementById(id)){js=d.createElement(s);js.id=id;js.src="//platform.twitter.com/widgets.js";fjs.parentNode.insertBefore(js,fjs);}}(document,"script","twitter-wjs");

The 2014 Banff Mountain Film Festival World Tour

Sponsored By: Skinny Skis

Previewed By: Adam Glos

Saturday, Feb. 8th / 8 pm // Sunday, Feb 9th / 7 pm

Jackson Hole High School ...

Read More

Tweet

!function(d,s,id){var js,fjs=d.getElementsByTagName(s);if(!d.getElementById(id)){js=d.createElement(s);js.id=id;js.src="//platform.twitter.com/widgets.js";fjs.parentNode.insertBefore(js,fjs);}}(document,"script","twitter-wjs");

Moon Taxi

Previewed By: Ellie Stratton-Brook

Saturday January, 25th

Pink Garter Theatre // Jackson, WY

With special guests the Acoustic Weapons

Doors - 8:00pm // Show - 9:00pm

Tickets: $14 in advance // Buy Tickets ...

Read More

Tweet

!function(d,s,id){var js,fjs=d.getElementsByTagName(s);if(!d.getElementById(id)){js=d.createElement(s);js.id=id;js.src="//platform.twitter.com/widgets.js";fjs.parentNode.insertBefore(js,fjs);}}(document,"script","twitter-wjs");

2014 Coldsmoke Awards

Previewed By: Stephen Williams

Saturday January, 18th

Emerson Cultural Center, Bozeman MT

North of the Sun - Filmhuset AS

Never Not Part 2 - Nike

Valhalla - Sweetgrass Productions

Previous Photos

Read More

Tweet

!function(d,s,id){var js,fjs=d.getElementsByTagName(s);if(!d.getElementById(id)){js=d.createElement(s);js.id=id;js.src="//platform.twitter.com/widgets.js";fjs.parentNode.insertBefore(js,fjs);}}(document,"script","twitter-wjs");

Warren Miller's Ticket to Ride

Previewed By: Stephen Williams

Friday December, 20th

Pink Garter Theatre

All Ages Showing - 6:00 pm

21+ Showing - 9:00pm

$16 / Buy Tickets Online

Read More

Avalanche Awareness Night

Thursday 12/05 - 6:30 to 9:30pm

Jackson Hole Center for the Arts

$5 Donation benefits Teton County Search and Rescue

Previewed by: Stephen Williams

From the time that Powder Magazine's annual Buyer's ...

Read More

Tweet

!function(d,s,id){var js,fjs=d.getElementsByTagName(s);if(!d.getElementById(id)){js=d.createElement(s);js.id=id;js.src="//platform.twitter.com/widgets.js";fjs.parentNode.insertBefore(js,fjs);}}(document,"script","twitter-wjs");

03/20/14 - Spring is right around the corner and with such a high snowpack in Jackson Hole, the touring season will be awesome. Doug Hayden, Kevin Salys and Tyler ...

Read More

Tweet

!function(d,s,id){var js,fjs=d.getElementsByTagName(s);if(!d.getElementById(id)){js=d.createElement(s);js.id=id;js.src="//platform.twitter.com/widgets.js";fjs.parentNode.insertBefore(js,fjs);}}(document,"script","twitter-wjs");

03/15/14 - What a perfect day to be in the mountains. Fresh snow, clear sunny skies and just a little wind. Alex Howell takes a moment to take in ...

Read More

Tweet

!function(d,s,id){var js,fjs=d.getElementsByTagName(s);if(!d.getElementById(id)){js=d.createElement(s);js.id=id;js.src="//platform.twitter.com/widgets.js";fjs.parentNode.insertBefore(js,fjs);}}(document,"script","twitter-wjs");

03/11/14 - Springtime pow surfing with Kyle Martin from Dragon Alliance as he rips into 13" of new snow under bluebird skies at Grand Targhee Resort. Photographer: Kevin Cass ...

Read More

Tweet

!function(d,s,id){var js,fjs=d.getElementsByTagName(s);if(!d.getElementById(id)){js=d.createElement(s);js.id=id;js.src="//platform.twitter.com/widgets.js";fjs.parentNode.insertBefore(js,fjs);}}(document,"script","twitter-wjs");

03/10/14 - 2nd Annual Ski Joring Championships

Written and Photographed By: Stephen Williams

Ski Joring is an event with a perfect mix of Jackson Hole's historic cowboy culture and the new ...

Read More

Tweet

!function(d,s,id){var js,fjs=d.getElementsByTagName(s);if(!d.getElementById(id)){js=d.createElement(s);js.id=id;js.src="//platform.twitter.com/widgets.js";fjs.parentNode.insertBefore(js,fjs);}}(document,"script","twitter-wjs");

Canyon Kids Release Double EP

Written By: Adam Glos

Photos by: Christie Quinn

In case you missed it, the debut album from Canyon Kids hit the electronic shelves recently, proving once again ...

Read More

Tweet

!function(d,s,id){var js,fjs=d.getElementsByTagName(s);if(!d.getElementById(id)){js=d.createElement(s);js.id=id;js.src="//platform.twitter.com/widgets.js";fjs.parentNode.insertBefore(js,fjs);}}(document,"script","twitter-wjs");

<

Head for the Hills

Previewed By: Ellie Stratton-Brook

Thursday March, 6th

Town Square Tavern // Jackson, WY

9:00pm // Tickets: $10 // Buy Tickets Online

Although you may have seen many bluegrass bands around ...

Read More

Tweet

!function(d,s,id){var js,fjs=d.getElementsByTagName(s);if(!d.getElementById(id)){js=d.createElement(s);js.id=id;js.src="//platform.twitter.com/widgets.js";fjs.parentNode.insertBefore(js,fjs);}}(document,"script","twitter-wjs");

03/02/14 - Mark Byall slashes a line in the Jackson Hole Mountain Resort backcountry as the consistent flow of snow continues into March. Photographer: Stephen Williams

Previous Photos

Read More

Tweet

!function(d,s,id){var js,fjs=d.getElementsByTagName(s);if(!d.getElementById(id)){js=d.createElement(s);js.id=id;js.src="//platform.twitter.com/widgets.js";fjs.parentNode.insertBefore(js,fjs);}}(document,"script","twitter-wjs");

02/23/24 - A skier flies off a jump being pulled behind a horse racing down a track at Melody Ranch just south of Jackson for the 2nd Annual Ski ...

Read More

Tweet

!function(d,s,id){var js,fjs=d.getElementsByTagName(s);if(!d.getElementById(id)){js=d.createElement(s);js.id=id;js.src="//platform.twitter.com/widgets.js";fjs.parentNode.insertBefore(js,fjs);}}(document,"script","twitter-wjs");

02/22/14 - February has been incredible in Jackson Hole and it's not quite over yet. Marian Herbick digs into the bottom half of Four Pjnes with more fresh snow ...

Read More

Tweet

!function(d,s,id){var js,fjs=d.getElementsByTagName(s);if(!d.getElementById(id)){js=d.createElement(s);js.id=id;js.src="//platform.twitter.com/widgets.js";fjs.parentNode.insertBefore(js,fjs);}}(document,"script","twitter-wjs");

02/21/14 - Nick Grenoble left his snorkel at home and had to come up for air between trips to the whiteroom. Jackson Hole Mountain Resort was unbelievably deep today ...

Read More

Tweet

!function(d,s,id){var js,fjs=d.getElementsByTagName(s);if(!d.getElementById(id)){js=d.createElement(s);js.id=id;js.src="//platform.twitter.com/widgets.js";fjs.parentNode.insertBefore(js,fjs);}}(document,"script","twitter-wjs");

The 2nd Annual North American Skijoring Championships

Previewed By: Adam Glos

Saturday, February 22nd - 12:00pm

1 Sunday, February 23rd - 11:00am

Melody Ranch // Jackson, WY

General Admission: $10 // Kids 12 and ...

Read More